Investment Management Philosophy

A disciplined approach by investors with right exposure and proper asset allocation can help in successful long-term wealth creation.

We at NJAMPL have been pioneering the mechanism of “Rules Based Investing” as against “Active Management”.

Rules based investing is a process oriented way of fund management wherein:

- The selection of the underlying is based on a pre defined set of rules

- The fund manager bias has been eliminated

- The rules help the portfolio remain “true to label” at all times

- The rules based models are able to be credibly back tested for their performance and volatility in various scenarios as there is no human intervention

The rules based funds are gaining traction globally and in India as it becomes tough to beat the benchmark when the information arbitrage becomes low when the market matures.

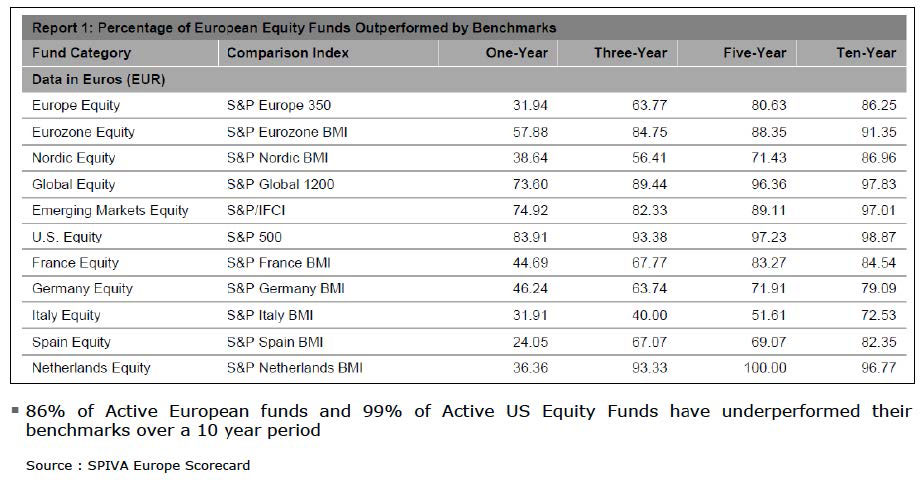

Exhibit 1: Active funds beaten by benchmarks in the world over

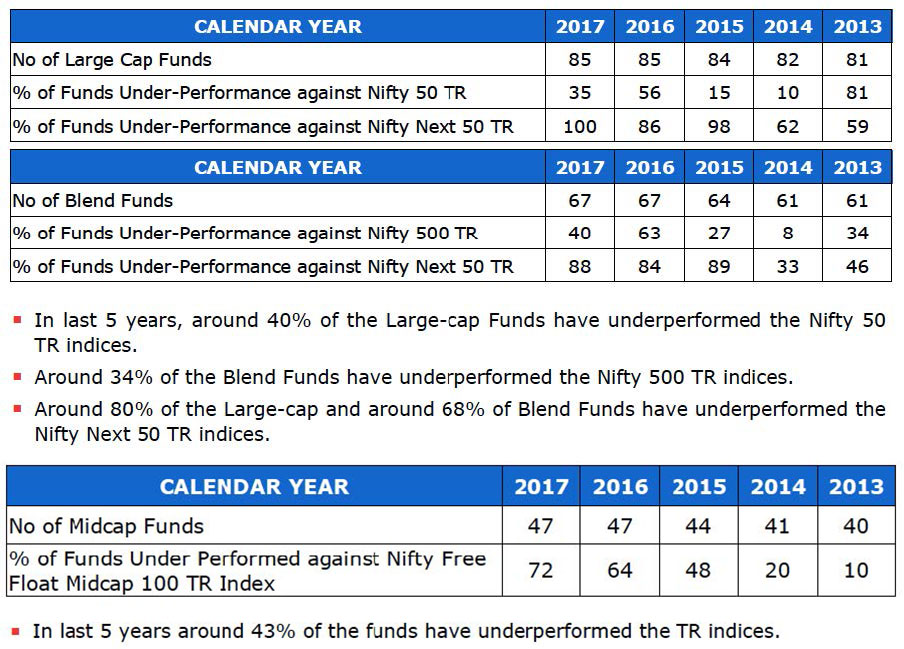

Exhibit 2:

So at NJAMPL we have been following the mechanism of a systematic Rules Based Investment Approach for the various products that are manufactured and offered to clients.

At NJAMPL we also believe that different types of clients have disparate risk appetites and investment horizons, so its important to provide a wide range of products on both Pure Equity and Dynamic Asset Allocation side.